In 2026, fintech security is not optional—it’s mission-critical.

With billions of dollars flowing through digital platforms, the fintech industry is a top target for cyberattacks. In fact, IBM’s latest report shows that the average cost of a breach in the financial sector is over $5.9 million—and rising.

For fintech founders and tech teams, this means one thing: you must build secure fintech systems from day one. A slick UI and fast onboarding won’t matter if your users don’t feel their data is safe.

And let’s be clear: data encryption in fintech isn’t just a nice-to-have—it’s a must. But encryption alone isn’t enough. You also need strong authentication, tokenization, detailed audit logs, and full compliance with frameworks like PCI DSS and SOC 2.

In this post, we’ll break down the top 7 data security practices every fintech company must follow in 2026. Whether you’re a startup building your MVP or a growth-stage firm scaling fast, these strategies will help you stay compliant, gain user trust, and ensure fintech data protection at every level.

Let’s dive in.

Top 7 Fintech Data Security Practices

Implement End-to-End Data Encryption

When it comes to fintech data protection, encryption is your first line of defense.

Data encryption in fintech ensures that even if attackers gain access to your systems, they can’t read or misuse sensitive information—like user credentials, payment details, or transaction logs.

In 2026, AES-256 encryption is the industry standard. It’s the same level of encryption used by governments and military institutions. Combine that with TLS 1.3 for encrypting data in transit, and you’re already ahead of many competitors.

But here’s the catch: encryption needs to be end-to-end.

That means:

- 🔒 At rest: Encrypt databases, backups, and storage using tools like AWS KMS or Azure Key Vault.

- 🚀 In transit: Use HTTPS with modern TLS protocols to secure APIs and data flows between services.

- 🛡️ In use: Consider confidential computing or field-level encryption for highly sensitive operations.

Secure fintech systems don’t leave any data unguarded. Encryption should cover every layer—from the mobile app to backend services to third-party integrations.

💡 Pro Tip: Don’t roll your own crypto. Use battle-tested libraries and cloud-native tools for encryption management. And always rotate your keys regularly.

Adopt Tokenization for Sensitive Data

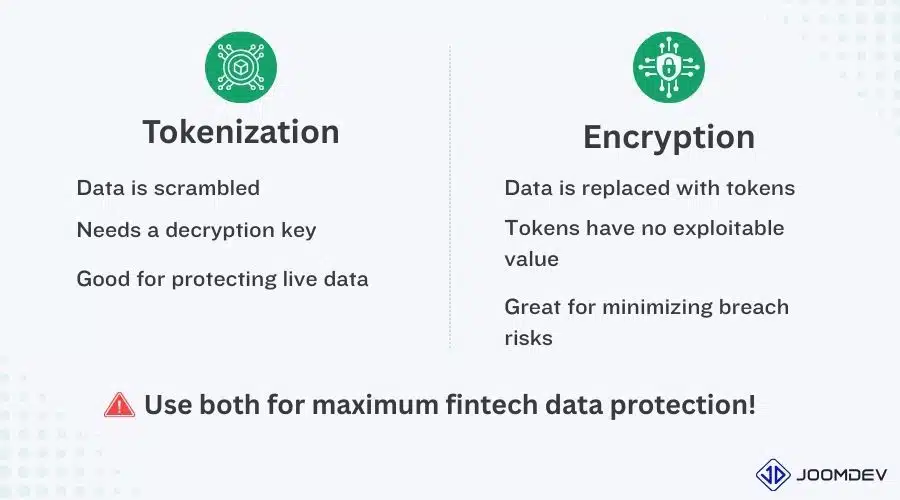

While encryption scrambles data, tokenization replaces it altogether.

In simple terms, tokenization swaps sensitive information—like credit card numbers or bank account details—with non-sensitive tokens that have no exploitable value. The real data is stored safely in a secure token vault, far away from prying eyes.

This is a game-changer for fintech security.

Let’s say a hacker gets into your system. If you’ve tokenized your data, all they’ll find are random tokens—useless without the vault. That’s why tokenization in fintech is becoming standard for things like:

- 🔢 Credit and debit card storage

- 🆔 Personally identifiable information (PII)

- 🧾 Transaction metadata

- 🧬 Health or insurance data (if applicable)

Used alongside AES-256 encryption, tokenization dramatically reduces your attack surface—especially when dealing with PCI DSS or SOC 2 compliance requirements.

💡 Fintech Tip: Tokenization is especially useful if you’re processing payments. Tools like Stripe, Vault by Very Good Security, or AWS Payment Cryptography make implementation easier and compliant by default.

Why It Works:

- Keeps real data out of your app’s attack surface

- Helps with PCI DSS scope reduction

- Boosts fintech data protection without compromising app performance

If you want to build secure fintech systems in 2026, tokenization is no longer optional—it’s essential.

Enforce Multi-Factor Authentication (MFA)

Strong passwords are no longer enough. In fintech, relying only on passwords is like locking your front door but leaving the windows wide open.

Multi-Factor Authentication (MFA) adds that critical second (or even third) layer of protection. It’s one of the simplest yet most effective ways to strengthen fintech security and protect users from account takeovers.

In 2026, every secure fintech system should enforce MFA—especially for:

- Customer logins

- Admin dashboards

- API access for partners

- Internal tools and employee accounts

Popular MFA methods you should implement:

- Time-based OTPs (One-Time Passwords) via apps like Google Authenticator

- Biometric authentication (fingerprint or face recognition)

- Hardware security keys (like YubiKey)

- Device fingerprinting for an extra invisible security layer

By forcing attackers to steal not just a password but also a device or biometric trait, you make breaches much harder.

💡 Pro Tip: Always offer app-based authenticators or hardware keys over SMS codes, which are vulnerable to SIM-swapping attacks.

MFA not only helps protect customer accounts but also plays a critical role in regulatory compliance frameworks like SOC 2 and PCI DSS. Many fintech regulators now expect MFA as a baseline requirement for fintech data protection.

Use a DevSecOps-Driven Development Approach

One of the smartest data security practices fintech companies can adopt in 2026 is to shift security left—baking it into every stage of the development process.

This is where DevSecOps comes in.

Instead of treating security as a final checklist before launch, DevSecOps integrates security testing, code analysis, and vulnerability scanning early and often. The goal? To catch and fix issues long before they become expensive risks.

For companies building secure fintech systems, adopting a DevSecOps approach is non-negotiable. It means:

- Automated code scans (tools like Snyk, SonarQube, Checkmarx)

- Security gates in CI/CD pipelines to block risky deployments

- Infrastructure as Code (IaC) security reviews

- Continuous penetration testing in staging environments

💡 Pro Tip: Train developers on secure coding standards (like OWASP Top 10) and encourage a “security first” mindset across teams.

Why it matters:

- Speeds up regulatory compliance (PCI DSS, SOC 2)

- Reduces technical debt and patching costs later

- Helps avoid last-minute delays due to failed security audits

In short, DevSecOps transforms security from a blocker into a business accelerator—a critical advantage in the fast-moving world of fintech.

✅ By embedding DevSecOps into your culture, you’re not just ticking a box—you’re building future-proof fintech data protection that scales with you.

Maintain Detailed Audit Trails & Logging Systems

If something goes wrong, you need to know exactly what happened—and fast.

That’s why maintaining detailed audit trails and secure logging systems is a vital part of strong data security practices in fintech.

Audit trails act like a security camera for your apps. They capture critical events such as:

- User logins and access attempts

- Admin actions like data edits or role changes

- API calls and system changes

- Failed or suspicious activities

In the world of secure fintech systems, good logs aren’t just nice to have—they’re essential for compliance (PCI DSS, SOC 2, GDPR) and for investigating breaches if they happen.

Best Practices for Audit Trails and Logging:

- Centralized logging: Use systems like ELK Stack (Elasticsearch, Logstash, Kibana) or AWS CloudTrail

- Immutable logs: Once captured, logs shouldn’t be editable

- Retention policies: Keep logs for at least 12–18 months to meet compliance standards

- Anomaly detection: Set up real-time alerts for unusual patterns

💡 Pro Tip: Always log sensitive events, but never log sensitive data like passwords or full card numbers. Mask or hash that information before logging.

✅ Having robust audit trails doesn’t just help you pass audits—it helps you respond faster to threats, meet legal obligations, and prove your commitment to fintech data protection.

In fintech, what you can’t see can hurt you. Good logs give you visibility—and visibility equals security.

Stay Aligned with Regulatory Compliance (SOC 2, PCI DSS)

Following strong data security practices is not just good for protecting your users—it’s also required by law.

Fintech companies operate in one of the most regulated industries. In 2026, staying compliant with standards like SOC 2, PCI DSS, and GDPR is no longer optional—it’s critical for survival.

Here’s why compliance matters:

- It builds trust with customers, investors, and partners

- It protects you from heavy fines and lawsuits

- It proves you take fintech data protection seriou

Key Frameworks You Should Focus On:

- SOC 2 (System and Organization Controls): Focuses on security, availability, processing integrity, confidentiality, and privacy. It’s crucial for fintech platforms that handle customer data.

- PCI DSS (Payment Card Industry Data Security Standard): Required if you store, process, or transmit credit card information.

- GDPR/CCPA: Critical if you’re handling customer data from Europe or California.

✅ To stay compliant, make sure you:

- Perform risk assessments regularly

- Maintain secure fintech systems with encryption and tokenization

- Document your data security practices thoroughly

- Implement strict access controls and audit trails

- Partner with vendors who are also compliance-certified

💡 Pro Tip: Being “compliance-ready” also shortens sales cycles when dealing with banks, payment processors, and enterprise clients.

Staying aligned with regulations isn’t just a paperwork exercise—it’s a competitive advantage. In 2026 and beyond, compliance is a core pillar of fintech security.

Bonus Tips for Startups: How to Stay Secure with Limited Resources

Building a fintech startup is exciting—but it’s also risky if you overlook security early on.

Many early-stage fintech companies focus heavily on product development and growth, leaving data security practices for “later.”

Big mistake.

In 2026, fintech startups must think about data protection right from the MVP stage.

Here’s how you can boost your early-stage fintech security without blowing your budget:

✅ Start with Strong Foundations:

- Implement end-to-end data encryption (TLS 1.3 for transit, AES-256 for storage).

- Use tokenization services if you handle sensitive customer data.

✅ Use Low-Cost or Free Security Tools:

- Cloudflare: Basic DDoS protection and web application firewall (WAF)

- AWS Cognito or Auth0 Free Tier: Secure authentication and user management

- Let’s Encrypt: Free SSL/TLS certificates

- Snyk or Dependabot: Automated security scanning for code repositories

✅ MVP Security Best Practices:

- Limit data collection: Only store what you absolutely need.

- Role-based access controls (RBAC): Don’t give all employees admin access.

- Regular backup schedules: Use automated cloud backups with encryption.

- Simple incident response plan: Even a 1-page plan is better than none.

💡 Startup Tip: Invest early in secure coding and good logging practices—it’s cheaper to build right than to fix breaches later.Building secure foundations from Day 1 shows investors, customers, and regulators that you take fintech data protection seriously. And it sets you apart in a crowded, competitive space.

Frequently Asked Questions

What is the best data encryption method for fintech apps?

The best data encryption method for fintech apps in 2026 is AES-256 encryption combined with TLS 1.3 for data in transit.

AES-256 is widely trusted for its strength and is considered the gold standard for fintech data protection. Always use proven, industry-standard encryption libraries rather than building your own.

How do fintech companies secure customer data?

Fintech companies secure customer data by following strict data security practices such as:

– End-to-end encryption of data at rest and in transit

– Tokenization of sensitive information

– Multi-factor authentication for user and admin accounts

– Regular security audits and penetration testing

– Strict access controls and detailed audit trails

Building secure fintech systems starts with a proactive approach to risk management and compliance.

What is the difference between tokenization and encryption?

Encryption scrambles sensitive data using mathematical algorithms, making it unreadable without a decryption key.

Tokenization, on the other hand, replaces sensitive data with non-sensitive placeholders (tokens) that have no exploitable value outside the system.

In fintech, using both data encryption and tokenization together provides maximum protection against data breaches.

Why is SOC 2 important for fintech startups?

SOC 2 compliance proves that a fintech company follows strict security, availability, and confidentiality standards.

It’s crucial for building customer trust, scaling operations, and partnering with banks, payment processors, or enterprise clients.

For fintech startups, achieving SOC 2 early can also shorten sales cycles and open doors to bigger deals.

How often should fintechs conduct penetration tests?

Fintech companies should conduct penetration tests at least once every quarter or whenever major changes are made to their systems.

Regular testing is a key data security practice that helps uncover vulnerabilities before attackers do, ensuring ongoing fintech security and compliance with standards like PCI DSS and SOC 2.

Conclusion

In today’s fast-paced digital world, fintech security is no longer optional—it’s the foundation of trust, growth, and survival.

By following these top 7 data security practices, you can safeguard your platform, protect your customers, and stay ahead of regulatory demands in 2026.

From end-to-end data encryption and tokenization to DevSecOps and regular security audits, each step plays a vital role in building secure fintech systems that people can truly rely on.

Remember, strong fintech data protection isn’t just about technology. It’s about creating a culture of security, accountability, and continuous improvement.

Ready to take your fintech app’s security to the next level?

Partner with experts who understand the unique challenges of data encryption in fintech and can help you build fully compliant, future-proof platforms.

Let’s build something secure—together.